pay indiana unemployment tax online

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one. Indiana unemployment compensation is paid weekly.

Registering for an Indiana State Unemployment Tax Account.

. Unemployment Insurance is a program funded by employer contributions that pays benefits to workers who are unemployed through no fault of their own. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Indianas 2020-2023 WIOA State Plan.

Conduct an ongoing job search. Please DO NOT attempt to register until wages have been paid. For more information refer to the Instructions for Form 940.

Those who used tax preparation software or online services to file prepare returns for mail-in or file electronically should check to see that the company updated its software to add back unemployment. Will not have Indiana tax withheld or If you think the amount withheld will not be enough to pay your tax liability and You expect to owe more than 1000 when you file your. You have reached Indianas one stop shop for Unemployment Insurance needs - for Individuals who are Unemployed and for Employers.

FUTA comes with one big caveat. INtax only remains available to file and pay the following tax obligations until July 8 2022. If you cannot locate this number please call the agency at 317-233-4016.

Your weekly Indiana unemployment amount cannot be higher than 390. Business entities that have paid wages in Indiana and met employer qualifications are required to register with the Indiana Department of Workforce Development. Online filing information can be found at wwwUnemploymentINgov.

This service allows you to pay your Indiana Department of Workforce Development payments electronically and is a service of Value Payment Systems. Generally if you apply online you will receive your EIN immediately. Search by address Search by parcel number.

Claim a gambling loss on my Indiana return. INTAX only remains available to file and pay special tax obligations. You also can file a wage report online or adjust a filed wage report online.

Up to 25 cash back Note. Find Indiana tax forms. You will receive your Tax ID within a few hours of completing the online registration.

INTAX only remains available to file and pay special tax obligations until July 8 2022. Register with the Indiana Department of Revenue. Employers paying by debit or credit.

Online Payment Service by VPS. Unemployment Tax Payment Process. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Take the renters deduction. For Medicare tax Pay FUTA unemployment taxes which is 6 of the first 7000 of each employees taxable income. Through a partnership with 180 Skills the State of Indiana is offering free skills training to Indiana residents.

As an employer you must match this tax dollar-for-dollar. Indiana changed its unemployment compensation law in 2015. All payments must be made with US.

File my taxes as an Indiana resident while I am in the military but my spouse is not an. Unemployment Insurance is a collaborative federal-state program financed through mandatory employer payments into two separate trusts one administered by the United States Department of Labor USDOL and one administered by the State Workforce Agency which in Indiana is the Department of Workforce Development DWD. Companies often receive a FUTA tax credit for the unemployment contributions they pay to the state in which they do business.

If you are an employer with an existing SUTA account number be sure to check the Yes option button on the first screen you see after clicking New User on the ESS logon screen. To receive your benefits the DWD will issue you a KeyBank debit card or you can elect to have your benefits deposited into a checking or savings account. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Know how and when you will be paid. Sign up by December 31st to access the 180 Skills collection of over 700. Find Indiana tax forms.

To establish your Indiana UI tax account youll need a federal employer identification number EIN. If 2520 seems like a lot to pay in FUTA tax dont despair. Take the renters deduction.

Pay my tax bill in installments. Search for your property. Registering for an Indiana State Unemployment Tax Account.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247. Take your career to the next level The. Know when I will receive my tax refund.

Register online with the Indiana Department of Revenue on INBiz. If you expect to have income during the tax year that. You can apply for an EIN at IRSgov.

To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer. As a reminder individuals must apply for unemployment benefits online using a computer tablet or smart phone. Paying by e-check should notify their banking institution that electronic payments from T356000158 are authorized for Indiana SUTA payments.

Looking for a job thats a better match. Indiana Unemployment Rate is at 300 compared to 330 last month and 500 last year. Make payments by e-check and credit card The Uplink Employer Self Service System provides you with immediate access to services and information.

Have more time to file my taxes and I think I will owe the Department. Pay my tax bill in installments. By using our on-line registration system you will be able to receive your account number.

If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number. Please use our Quick Links or access on the. Claim a gambling loss on my Indiana return.

I need to file my 2020 Indiana individual income tax return and plan to file electronically or prepare my tax return using tax softwareonline services. Ad File your unemployment tax return free. Find more income tax information regarding unemployment insurance here.

For best search results enter a partial street name and partial owner name ie. Find Indiana tax forms. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year.

Pay the amount due on or before the installment. Electronic Payment debit block information. 124 Main rather than 124 Main Street or Doe rather than John Doe.

Know when I will receive my tax refund. Please contact us at 8008916499 and request a Tax Liability Status Auditor if you have an account in pending status. Have more time to file my taxes and I think I will owe the Department.

Find Indiana tax forms. Rules for Unemployment Insurance Tax Liability. All payments are processed immediately and the payment date is equal to the time you complete your transaction.

Great Addition Tax Attorney Tax Refund Tax Lawyer

Here S What Unemployed Hoosiers Should Know About The American Rescue Plan

Dwd Will Collect Unemployment Overpayments From Tax Refunds

Ess Employer Self Service Logon

Indiana Taxes For New Employees Asap Payroll Services

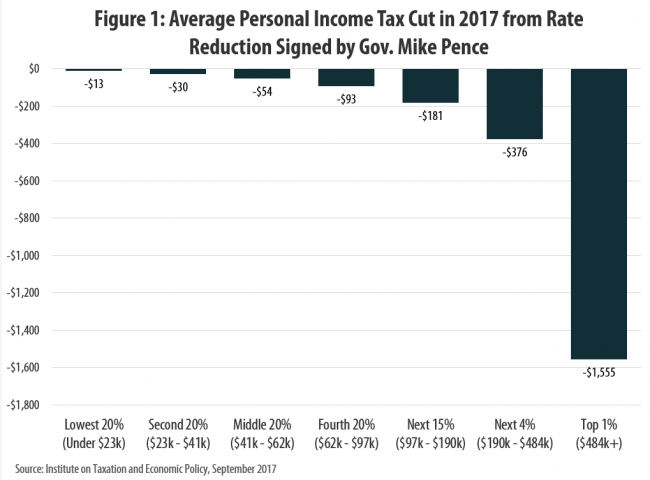

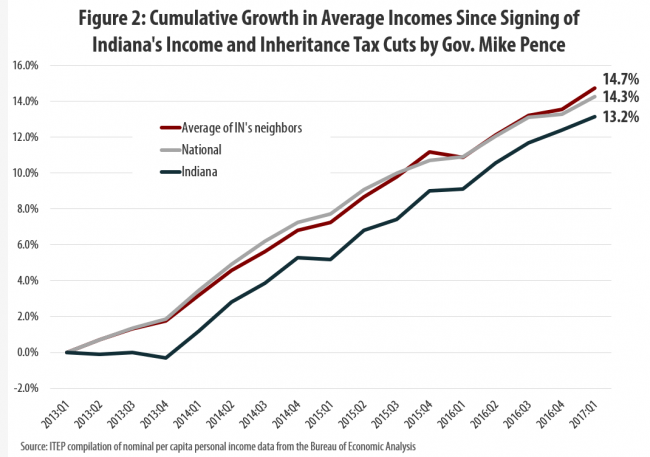

Indiana S Tax Cuts Under Mike Pence Are Not A Model For The Nation Itep

Dor Indiana Extends The Individual Filing And Payment Deadline

If You Have Employees Who Work In One State But Live In Another You Might Need To Know About Tax Resume Examples Introduction Letter Child Support Enforcement

Indiana Taxes For New Employees Asap Payroll Services

Historical Indiana Tax Policy Information Ballotpedia

Register With Dor And Dwd Inbiz

Secure Login Access Http Www Netankiety Pl The University Alliance Login Here Secure User Login To Univers Places To Visit I Am Awesome Interesting Reads

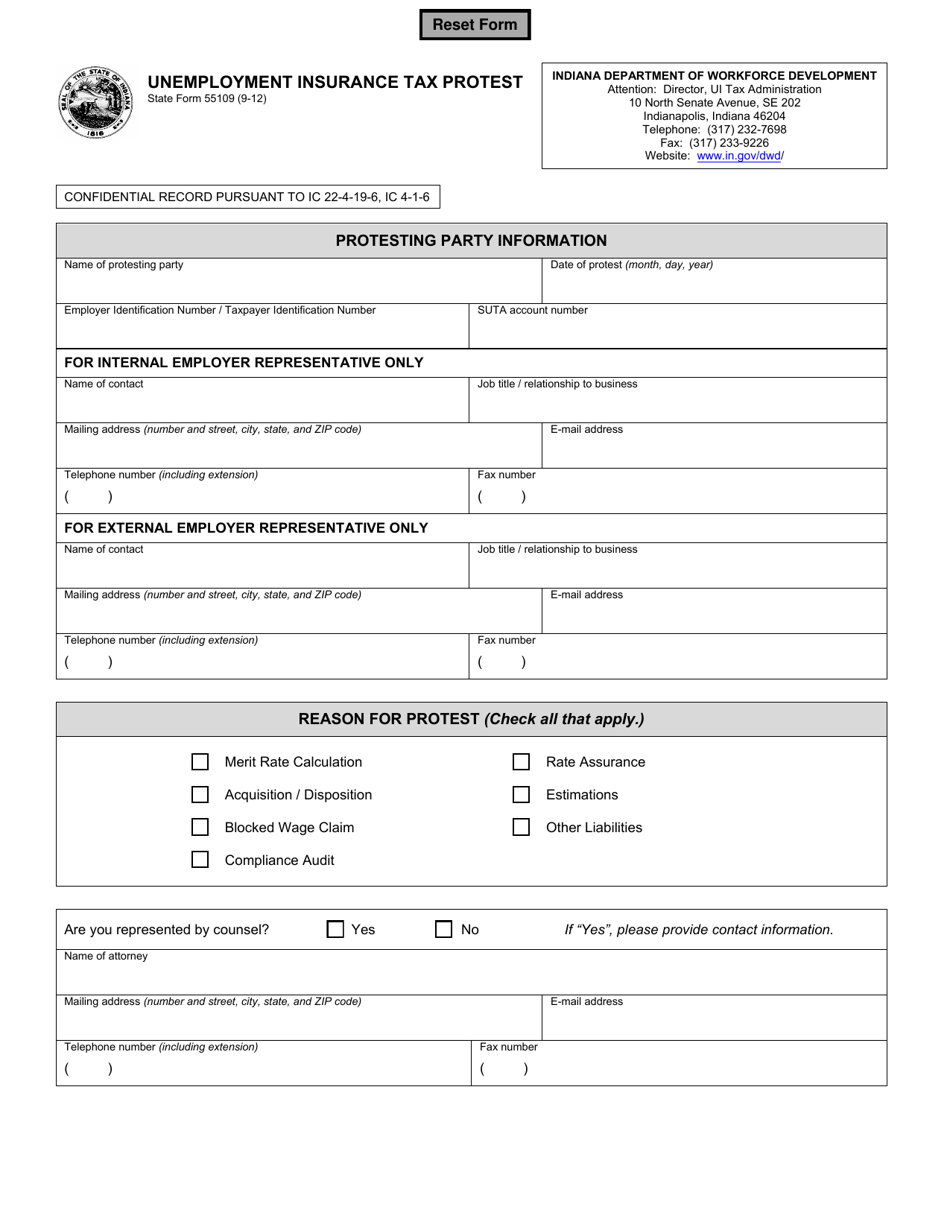

State Form 55109 Download Fillable Pdf Or Fill Online Unemployment Insurance Tax Protest Indiana Templateroller

Dor Indiana S Tax Dollars At Work

Solved Indiana State Tax For Cares Act 401k Withdrawal

Indiana S Tax Cuts Under Mike Pence Are Not A Model For The Nation Itep